On June 5, 2025, Property Technology Magazine introduced its inaugural Top 50 PropTech Index alongside its 80-page trends report titled The Great Rebuild: How PropTech Is Powering Real Estate’s Digital and Sustainable Renaissance. The launch highlights how real estate technology has moved from a fringe innovation to a foundational part of the industry worldwide.

The Top 50 Index ranks companies based on five criteria: revenue growth, capital raised, product innovation, trend adoption, and customer traction. The list includes both established leaders and emerging startups across a wide range of real estate technologies.

According to the report, the global PropTech market was valued at approximately $35 to $40 billion in 2024 and is projected to more than double, exceeding $100 billion by 2032. Despite broader challenges in venture capital markets, PropTech investment remained resilient. In 2023 alone, about $42 billion was invested in PropTech across 80 countries. During 2024, around 70 percent of all PropTech deals had an artificial intelligence component, with $3.2 billion specifically funneled into AI-driven real estate technologies.

Read Also: https://toplistings.com/commercial-real-estate-shows-cautious-optimism/

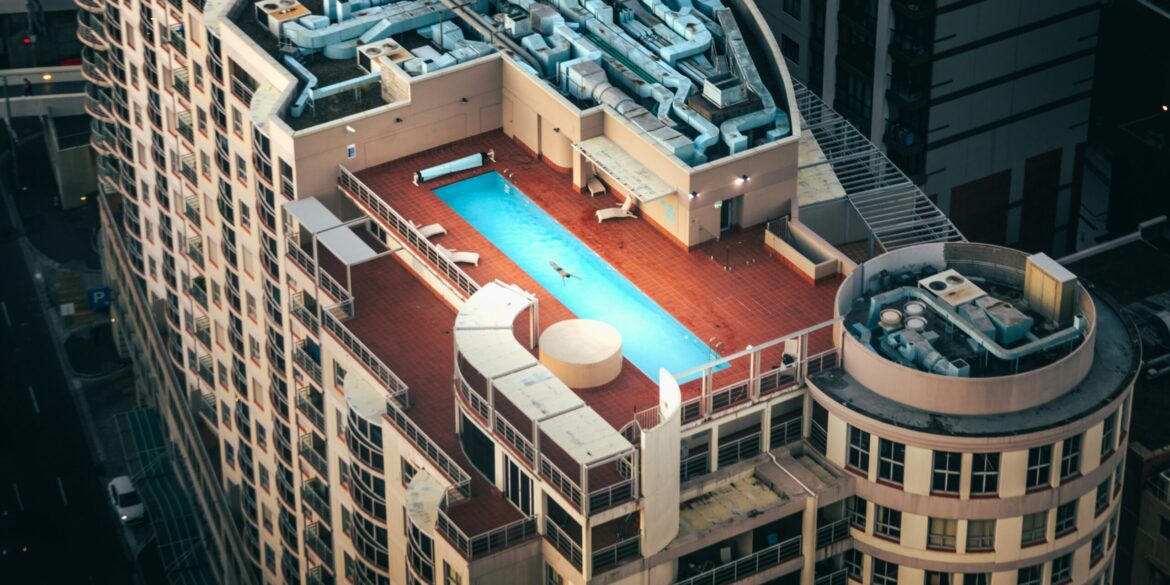

Smart-building solutions are becoming standard in new commercial developments. Approximately 75 percent of such projects now include integrated IoT systems from the ground up. These systems help monitor and manage everything from energy usage to maintenance needs, supporting both sustainability and cost-efficiency.

Regionally, the United States continues to command a leading share of global PropTech value, estimated between 27 and 40 percent. However, the Asia-Pacific region is experiencing the fastest growth, projected to expand at a compound annual rate of about 20.5 percent through 2032.

Bianca Ford, Editor-in-Chief of Property Technology Magazine, noted that PropTech has “crossed the Rubicon,” becoming embedded in every stage of the property lifecycle. From AI-driven underwriting and predictive maintenance to blockchain-enabled transactions and virtual leasing tools, technology is now central to how real estate is developed, financed, operated, and experienced.

The trends report offers a broader perspective on how PropTech is evolving in response to shifting capital flows, climate goals, and digital transformation demands. It portrays a sector that has emerged from macroeconomic challenges with a clearer strategy and growing investor confidence.

These findings reinforce the idea that PropTech is no longer an optional enhancement—it is essential infrastructure. The technologies now widely adopted across the industry include virtual tours for marketing, AI tools for underwriting and portfolio management, IoT-based energy systems for sustainability, and blockchain for secure and transparent deal execution.

Analysts forecast continued strong growth in the global PropTech sector, with projected compound annual rates of over 15 percent in the coming years. This momentum is being driven by investor and operator demand for smarter, more efficient, and more transparent property operations, as well as a heightened focus on ESG goals.

As PropTech firms scale operations and expand into new regions, including fast-developing smart city initiatives in Asia and Latin America, the industry is undergoing a fundamental transformation. For investors, real estate owners, and technology providers, the report makes clear that digital infrastructure is now a core element of real estate strategy.