Trends in Washington D.C. Housing Market Amid Changes

In the latest analysis of the housing market in Washington D.C., significant shifts have emerged since the commencement of President Trump’s second term. Current data from Altos reveals a noteworthy change in supply dynamics within the nation’s capital.

Inventory and Listings Surge

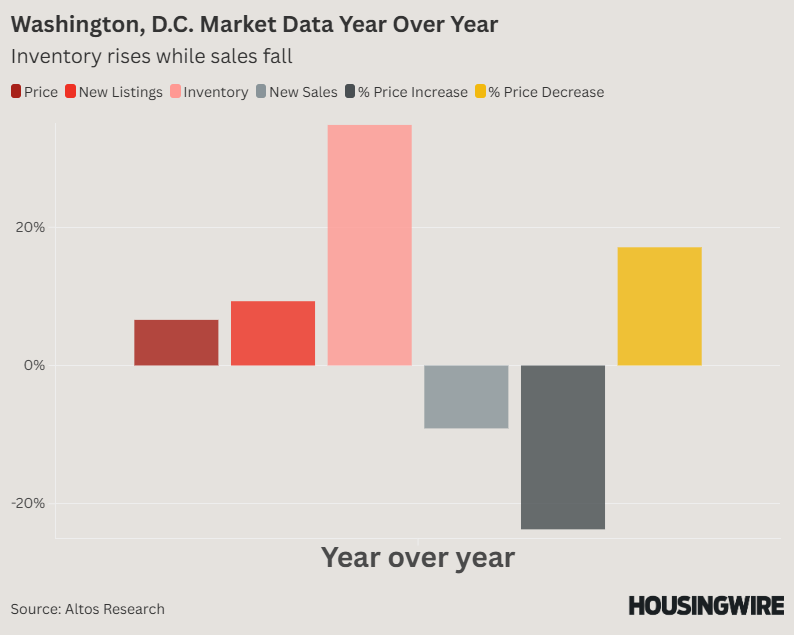

Recent figures indicate a robust increase in housing inventory, a departure from years of stagnation. As of now, the weekly average of homes available for sale has surged by 34.8% year over year, with new listings experiencing a corresponding uptick of 9.3% on a 90-day rolling basis.

While spring typically brings a seasonal rise in new listings, the recent data is particularly striking. A rapid transition from a 10.9% decrease in listings at the end of February to a notable increase highlights a significant shift in market conditions.

Buyer Response and Pending Sales

Despite the increase in available inventory, buyer activity has not kept pace. Pending home sales measured over a 90-day period have shown an annualized decline since February, following a robust performance in 2024.

Pricing Trends: Adjustments in Strategy

In response to the evolving market conditions, sellers have begun to adjust their pricing strategies. Traditionally, Washington D.C. has seen a higher percentage of price reductions compared to price increases—this trend appears to be changing.

During the latter part of 2024, listings with price increases were reported to be more than 50%, but this number has dropped to 23.7% recently. Conversely, the percentage of homes experiencing price cuts has risen by 17.1%.

Potential Influences on Market Activity

Several factors could be influencing the Washington D.C. housing market, particularly regarding federal employment. Though the recent federal layoffs and policy changes merit consideration, it’s essential to approach the situation with caution regarding causation and correlation.

Key contextual factors to consider include:

- Rising inventory, while a seasonal trend, reflects broader national patterns.

- The fluctuating status of federal agencies complicates the assessment of market impacts due to layoffs.

- New tariffs and economic policies under the Trump administration may encourage quicker seller responses while leading buyers to hesitate.

- Mortgage rates have escalated to around 7%, significantly impacting buyer sentiment and movement in the market.

Current Market Statistics

Since late February, the overall housing inventory in Washington, D.C. has climbed by an impressive 42%, while new listings have skyrocketed by 81% compared to 54% growth during the same period last year. However, new pending sales have also increased but at a lower percentage of 43.4%.

Conclusion: Looking Ahead

The next several months will be crucial for understanding the full impact of these market changes and federal policies. While the current landscape shows an increase in supply that is not yet matched by demand, ongoing analyses will help gauge the long-term effects of these developments on the D.C. housing market.