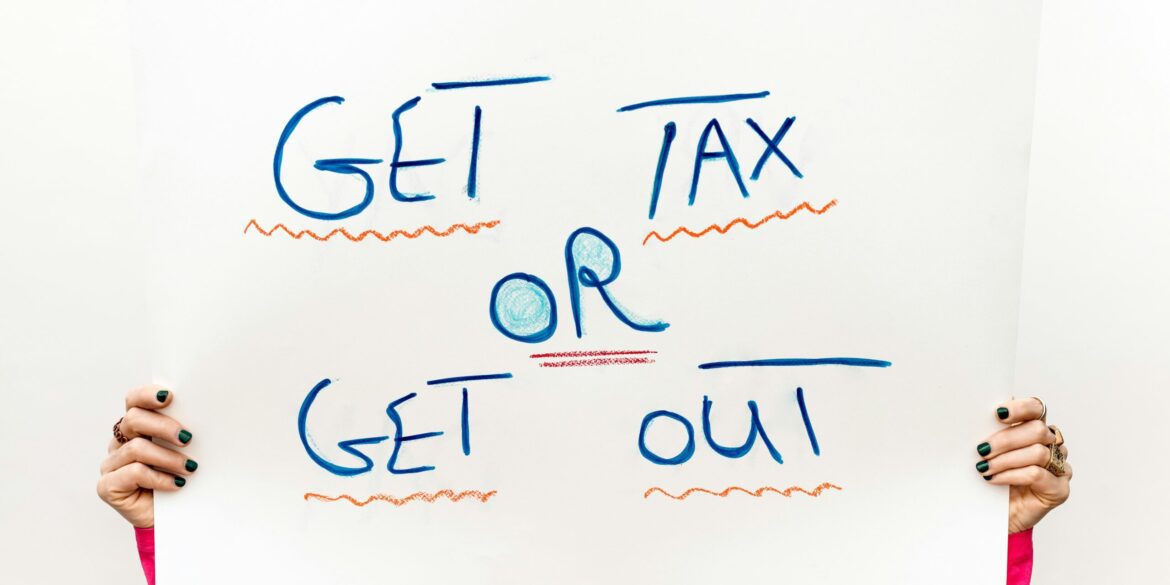

U.S. Department of Housing and Urban Development (HUD) unveiled a comprehensive proposal aimed at accelerating the construction of affordable housing nationwide through enhanced tax incentives. This move is part of a broader federal strategy to address the persistent shortage of affordable homes that has impacted millions of Americans across urban and rural communities.

Details of the Tax Incentive Proposal

The proposed policy package focuses primarily on strengthening the Low-Income Housing Tax Credit (LIHTC) program, the nation’s largest mechanism for financing affordable housing development. Key elements include:

-

Increased Credit Allocation: Expanding the dollar amount of tax credits available annually to developers, incentivizing more projects targeted at very low- and extremely low-income households.

-

Bonus Credits for Green Building: Offering additional credits to projects that meet stringent environmental and energy efficiency standards, promoting sustainability alongside affordability.

-

Streamlined Application Process: Simplifying application and compliance procedures to reduce administrative burdens and accelerate project timelines.

-

Tax Deductions for Preservation: Introducing new deductions for owners rehabilitating existing affordable housing stock, aimed at maintaining affordability over time.

HUD Secretary Elena Garcia emphasized, “Affordable housing is critical to economic stability and community health. These incentives aim to unleash private sector capital and innovation to meet our nation’s urgent housing needs.”

Context: The Affordable Housing Crisis

The shortage of affordable housing has been widely documented. According to the National Low Income Housing Coalition, there is a deficit of over 7 million affordable rental units for extremely low-income households.

Rising rents and home prices have exacerbated housing insecurity, contributing to homelessness and displacement, particularly in major metropolitan areas like Los Angeles, New York, and San Francisco.

The tax incentives seek to catalyze development where market forces alone have failed, by making affordable housing projects more financially viable for developers.

Stakeholder Reactions

Developers and affordable housing advocates have largely welcomed the proposal. Maria Hernandez, CEO of Affordable Homes Inc., stated, “Increasing LIHTC allocations and linking them to green building will encourage projects that are both socially and environmentally responsible.”

Tenant rights groups also praised the emphasis on preservation, which helps maintain affordable units in existing neighborhoods.

Some industry voices urged caution regarding regulatory complexity and recommended ongoing dialogue to ensure equitable distribution of benefits across regions.

Economic Impacts and Job Creation

Affordable housing construction has significant economic benefits, creating jobs in construction, materials manufacturing, and professional services.

The National Association of Home Builders estimates that every $1 billion invested in affordable housing generates over 9,000 jobs and $1.6 billion in economic activity.

By facilitating more projects, the tax incentives could stimulate regional economies and increase housing stability, improving health and education outcomes for residents.

Implementation Timeline and Next Steps

The proposal is currently in the public comment phase, with HUD inviting feedback from developers, community groups, and policymakers. Following this, Congress will review and consider legislation to codify the incentives.

HUD plans outreach programs to educate stakeholders and coordinate with state housing finance agencies responsible for LIHTC allocation.

Complementary Federal and State Initiatives

The tax incentives complement other federal efforts, including expanded rental assistance programs, homelessness prevention funding, and infrastructure investments that support affordable housing development.

Several states have enacted parallel policies, such as California’s “Housing Accelerator” fund and New York’s green building tax credits, aligning with the federal approach.

Challenges and Opportunities

While tax incentives are powerful tools, addressing the affordable housing crisis requires multifaceted strategies, including zoning reform, tenant protections, and community engagement.

Successful implementation will depend on transparency, equitable access, and monitoring to ensure projects serve intended populations.

Conclusion

The federal government’s proposed tax incentives represent a significant step toward expanding affordable housing in the United States. By leveraging financial tools to stimulate construction and preservation, the initiative aims to alleviate housing insecurity, promote sustainable development, and foster stronger communities.