Investing in commercial real estate is a fantastic way to boost your portfolio, especially if you want to move beyond stocks and residential properties. It’s key to understanding market trends, property valuation, and the legal aspects. Whether looking at an industrial warehouse, retail space, or office building, researching and planning are essential. Here’s a simple guide on how to invest in commercial real estate to help you get started.

Step 1: Understand the Commercial Market

Evaluating the current commercial real estate market performance and outlook is crucial to making informed investment decisions. This includes analyzing market trends, vacancy rates, rental rates, and factors related to supply and demand.

Solid commercial real estate market research—like stats, trends, economic indicators, and how specific sectors are doing—can help spot areas with the most growth potential. Sites like Loopnet, Deloitte, and CBRE give great market insights. These tools help you make smart decisions and create solid strategies to get the best return on your investment (ROI).

Step 2: Assemble a Skilled Team

It’s wise to assemble a team of experts when learning how to invest in commercial real estate. Ideally, this team includes the following people:

Commercial real estate agent: A commercial real estate agent guides you throughout your transaction, helps you meet requirements, find suitable properties, and negotiate favorable terms with sellers. Choosing an agent specializing in commercial real estate is essential to receive expert guidance.

Attorney: The attorney handles the legal aspects, verifying compliance standards, reviewing the purchase agreement, and addressing concerns for a smooth transaction.

Financial advisor: Your financial advisor assesses the viability of your commercial property investment by analyzing rental income potential and capital appreciation, ensuring it aligns with your financial goals.

Mortgage broker: A mortgage broker helps secure financing for your property by identifying the best lenders and negotiating favorable terms and interest rates.

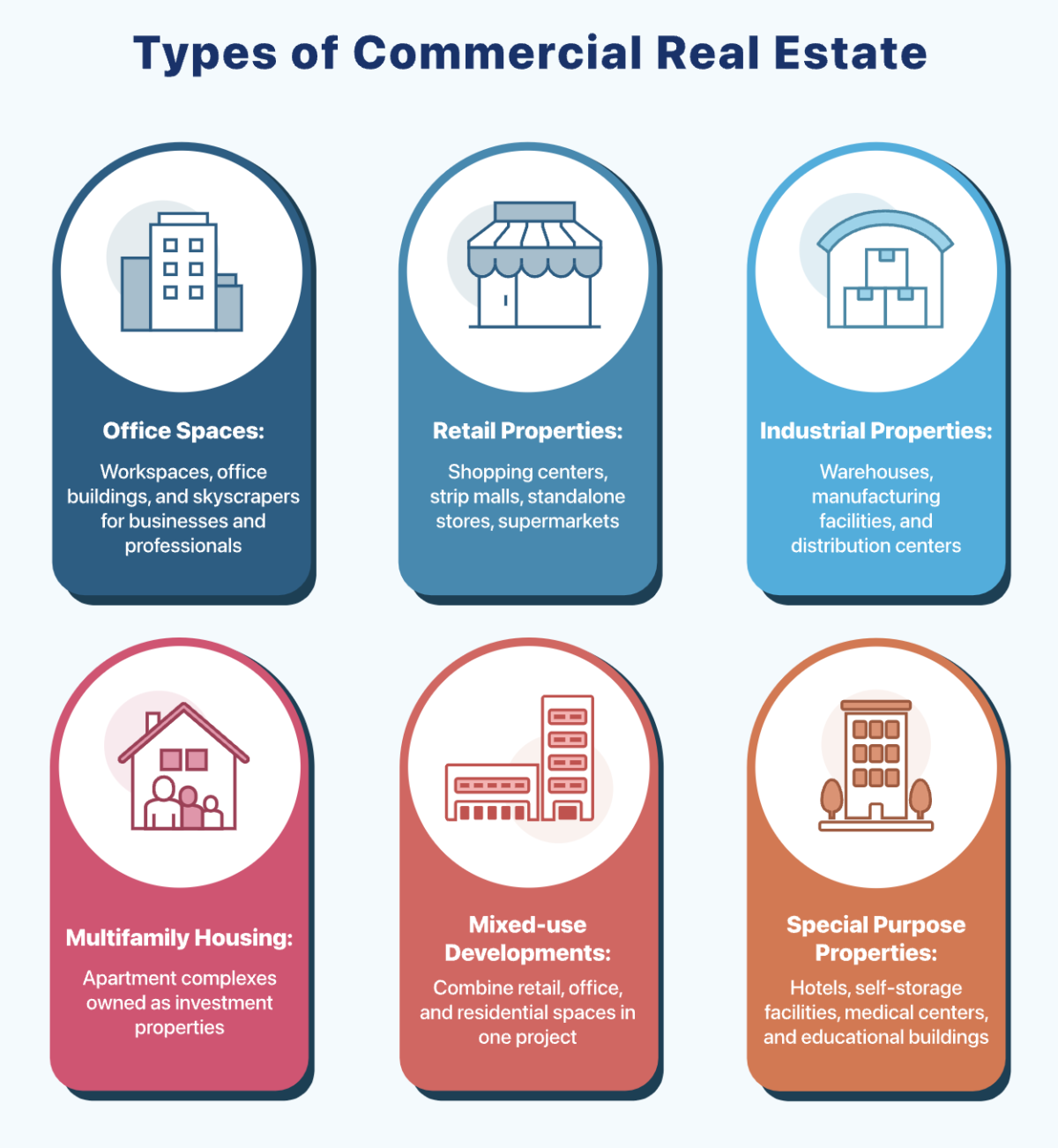

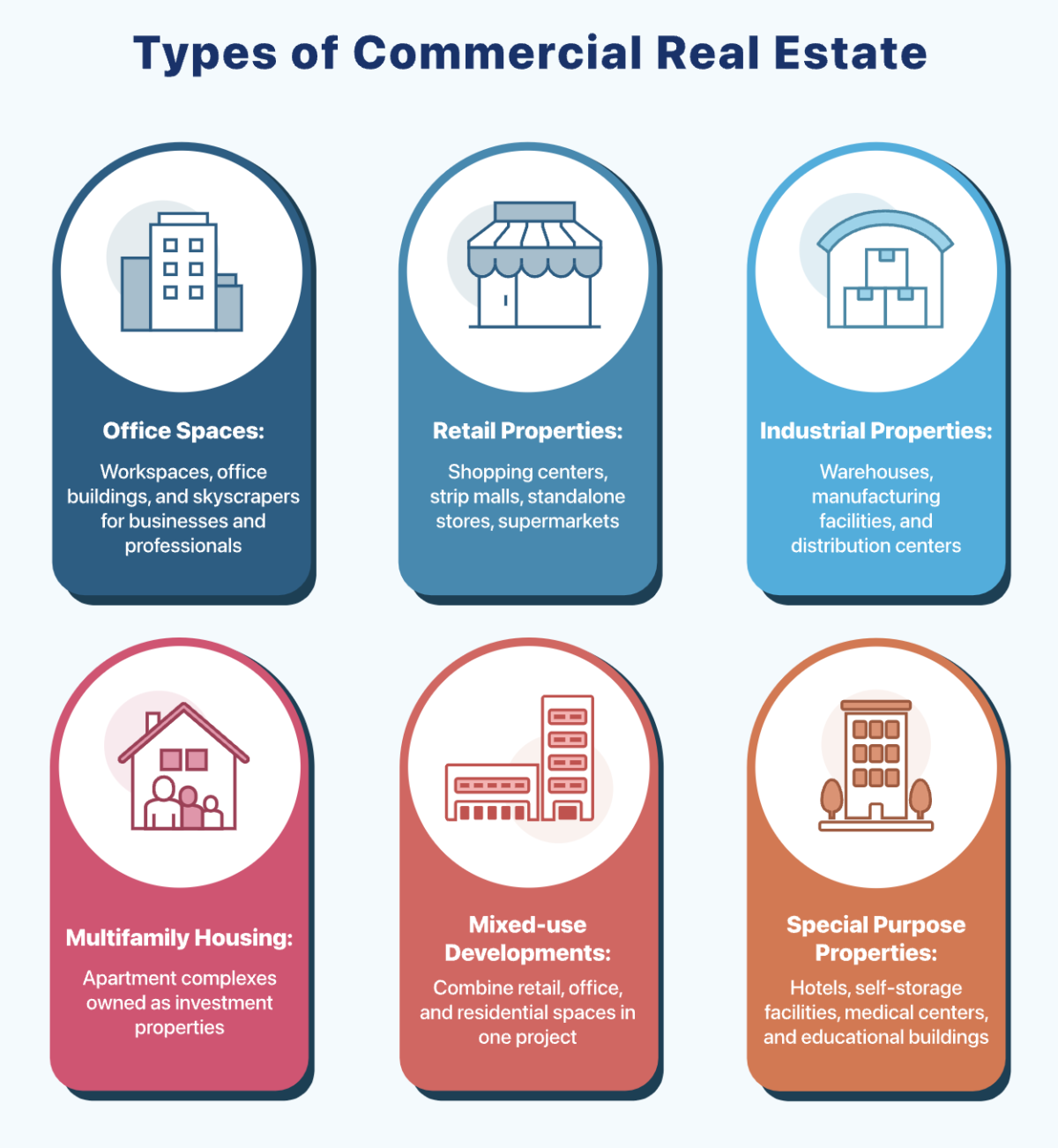

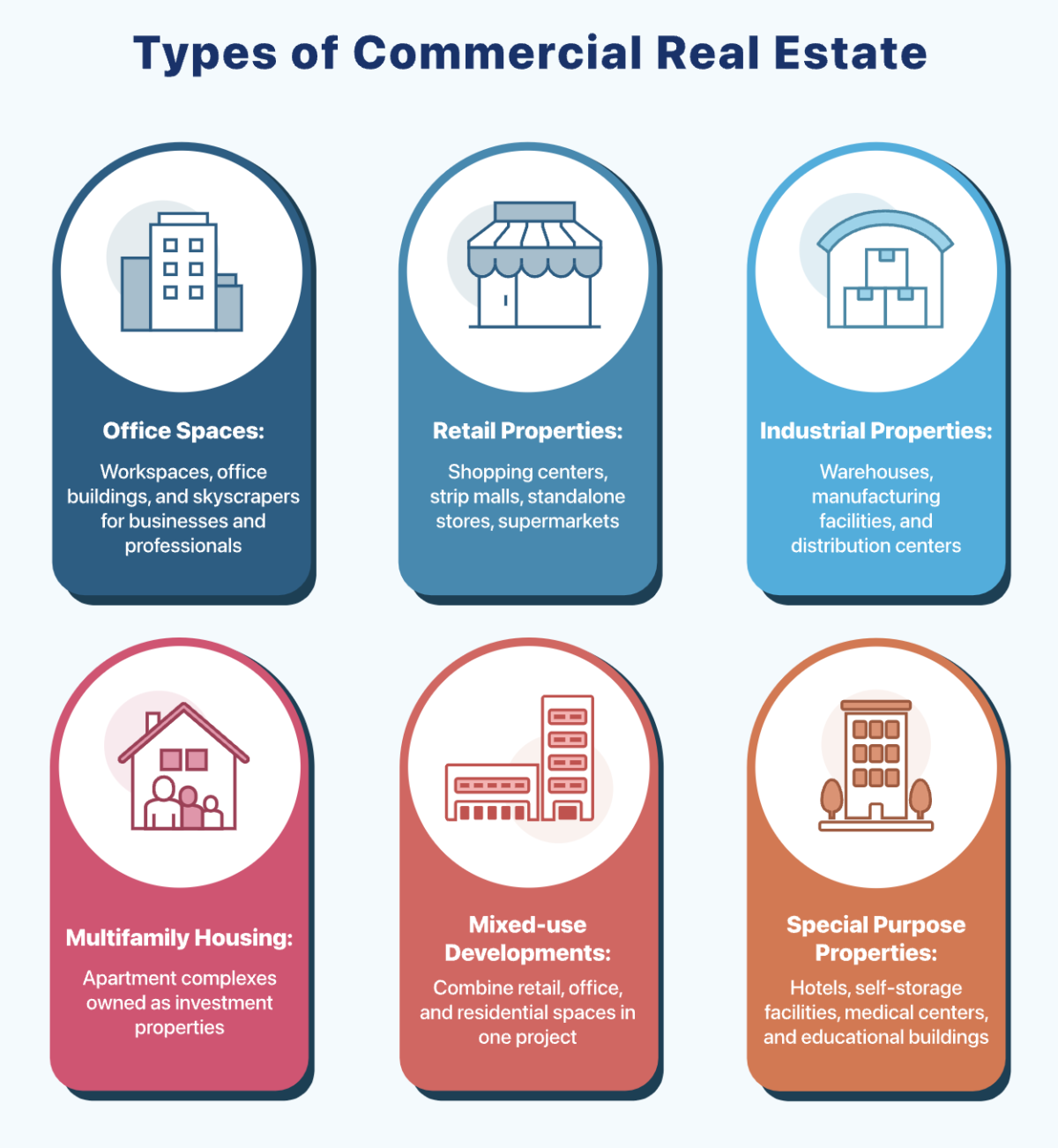

Step 3: Choose the Right Property Type

To learn more, click the sliders below to explore various types of properties available for investment:

Step 4: Conduct Thorough Due Diligence

Once you’ve found a promising commercial real estate investment opportunity, the next step is to complete due diligence. Do this by looking closer at the property’s financials, legal status, physical condition, and zoning regulations. Doing your homework upfront will help you identify any potential issues that might impact how profitable the investment could be. Let’s explore some key areas to pay attention to when considering how to invest in commercial property:

Financial performance: Analyze the property’s income generation, occupancy levels, and operational costs to assess its current market value and forecast its revenue potential.

Legal clearances: Investigate potential legal issues, such as outstanding liens or lawsuits that could affect the investment’s profitability. Ensure the property is free of legal disputes or issues that could result in costly legal battles.

Structural integrity: Assess the property for necessary repairs, maintenance, or upgrades. This will determine the property’s overall condition and estimate any potential costs associated with repairs or upgrades.

Zoning compliance: Ensure the investment is legal and compliant with local laws and regulations. This will prevent any potential legal issues down the line and validate the investment’s viability in the long term.

Step 5: Secure Financing

Commercial real estate investments typically require significant upfront capital. However, various financing options are available to help you secure the necessary funding. Below are some of the most common financing methods to consider:

Traditional Loans

Banks and other financial institutions commonly offer these loans, typically requiring a down payment of around 20% to 30% of the property’s purchase price. Interest rates and repayment terms vary, so shopping around and comparing different lenders is crucial to finding the best deal.

Real Estate Investment Trusts (REITs)

One terrific option for how to get started in commercial real estate investing is to look into real estate investment trusts or REITs. These companies buy and manage commercial properties, so you can buy shares in them. REITs can give you a nice, steady income through dividends and growth, making them a more passive investment method.

REITs take the hassle out of managing properties by handling all the day-to-day stuff. There are some nice tax benefits since REITs usually pay lower tax rates on dividends and don’t face corporate taxes on income they pass on to shareholders. This can lead to better returns overall.

Crowdfunding Platforms

Crowdfunding has become a trendy way to invest in real estate, including owning commercial real estate. These platforms let people pool their cash together to back a project, so they can invest smaller amounts than traditional loans or REITs. Not all crowdfunding platforms are the same, so it’s super important to dig into the details of the platform and the investment opportunity before you throw any money in.

Commercial Real Estate Loans

Here are some commercial real estate loan types you might want to consider:

Loan TypeInterest RateMaximum Loan AmountFunding TimelineLoan Term

SBA 7(a)Starts at base rate plus 3%Up to $5 millionWithin 30 daysUp to 25 years

SBA 504Pegged rate above current 10-year United States Treasury noteUp to $5.5 million30 to 90 daysUp to 25 years

Conventional Commercial Mortgage LoanVaries, generally between 5% and 8%No limit30 to 45 days5 to 25 years

Commercial Bridge LoanGenerally between 6% and 12%Varies, usually up to 85% loan-to-cost (LTC) ratio1 week to 30 days12 to 36 months

Commercial Hard Money LoanGenerally between 7% and 15%Varies, usually 65% to 80% LTC1 to 2 weeks12 to 36 months

Step 6: Manage Your Investment

If you’re looking at how to start investing in commercial real estate, consider purchasing a commercial real estate database to keep track of managing duties.

Alternatively, property management software can streamline operations by marketing your property, screening tenants, and managing leases. These solutions also handle tenant complaints and repairs, allowing you to focus on other business priorities while keeping your investment profitable.

Check out our article on finding the best commercial customer relationship management (CRM) tools to help you get started.

If you’re looking for solid property management software, check out Buildium. It has outstanding features that make managing commercial real estate a lot easier. One of the coolest things about Buildium is its built-in accounting system, which helps keep track of your financials and payments without the headaches. This not only saves you time but also cuts down on mistakes when it comes to money management. Plus, it helps with maintenance tasks, making it easier to respond to issues quickly.

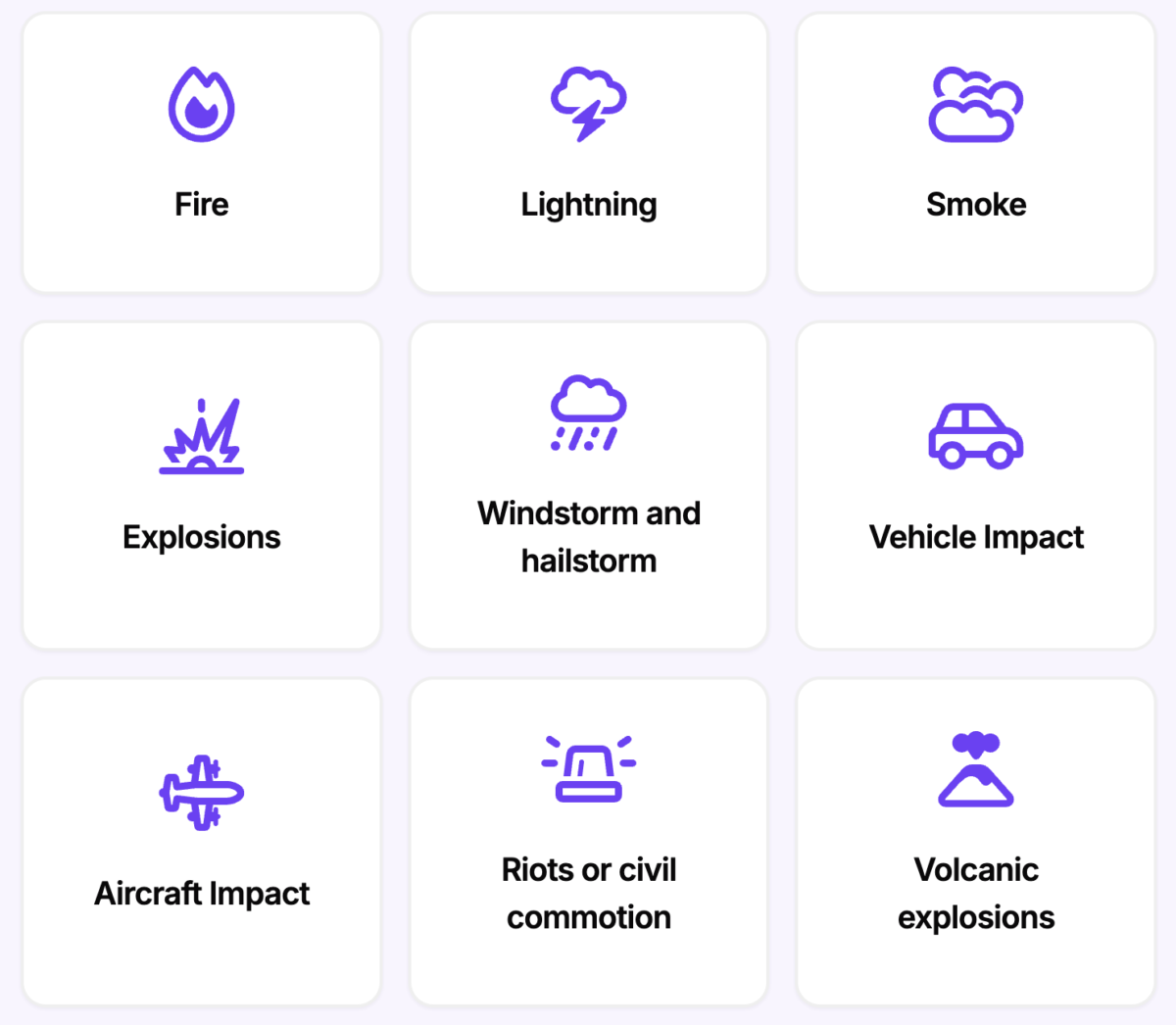

Step 7: Protect Your Investment

Most financial institutions require commercial property insurance to protect their interests in the property. Even if you buy the property outright, securing your investment with business insurance is wise. If you’re looking into how to start in commercial real estate, it’s essential to understand the role of commercial property insurance. This type of insurance covers certain damage, whether from mother nature, tenants, or others. If you own vacant land, consider premises liability insurance, which protects against claims from injuries occurring on your property.

I recommend Obie for commercial property insurance, which covers a variety of property types, including homes, multiplexes, apartment buildings, and condo units. What distinguishes Obie is its unique offering of insurance specifically designed for real estate investors, with no limit on the number of properties owned. Obie’s quoting and binding system, along with its direct-to-consumer approach, enables real estate investors and landlords to save up to 25% on their insurance costs.

Pros & Cons of Investing in Commercial Real Estate

Understanding how to get into commercial real estate investing is essential for success. It has the potential to bring in solid income, help diversify your portfolio, and even protect you from inflation. However, like any investment, it also comes with its fair share of risks and downsides.

ProsCons

Higher-income potential: Commercial real estate generally offers higher rental income and ROI than residential real estate.Higher initial investment: Commercial real estate requires a more significant upfront investment, making it less accessible for some investors.

Long-term leases: Commercial leases tend to be longer, providing stable income and reducing turnover costs.Complex management: Managing commercial properties can be more complex due to the specifics of commercial leases and property maintenance.

Inflation hedge: Property values and rents typically increase with inflation, protecting investors’ purchasing power.Market sensitivity: Commercial real estate investments can be more sensitive to economic cycles, affecting occupancy rates and property values.

FAQs

What type of commercial property is most profitable?

Most experts agree that multi-family properties, self-storage facilities, and well-located retail spaces like shopping centers are among the most profitable commercial properties. If you’re looking for how to invest in commercial real estate, these investments often have many tenants, provide stable rental income, and can yield good returns on investment.

What is a good ROI for commercial real estate?

A good return on investment (ROI) for commercial real estate typically ranges between 8% and 10%, depending on the property type, location, and market conditions. Properties in prime locations with stable tenant occupancy often yield higher returns. Also, calculate expected ROI by considering property management costs, maintenance, taxes, and potential vacancies. Ultimately, a “good” ROI should align with your financial goals and the specific commercial real estate market risks.

How do you invest in real estate with $1,000?

Investing in real estate with $1,000 is possible through a few strategic avenues. One effective way is through REITs, which allow you to purchase shares in commercial and residential real estate portfolios, similar to buying stocks. Another option is crowdfunding platforms that enable collective property investments with minimal initial capital. Both methods offer exposure to real estate markets without needing large upfront investments typically associated with property purchases.

Bringing It All Together

Diving into commercial real estate is like unlocking a treasure chest filled with chances to mix things up, earn some serious dough, and watch your investments grow! But, if you want to cruise smoothly through the commercial real estate game, it takes some savvy planning, a sprinkle of due diligence, and a dash of proactive management magic. Following the steps in this beginner’s guide and weighing the pros and cons, you’ll be ready to make some smart moves and snag those golden opportunities.

Don’t forget to drop your thoughts about how to invest in commercial real estate in the comments—I’d love to hear your thoughts! 😁