Whether you’re expanding your portfolio or adding a second home, vacation rental insurance should be part of your investment strategy. If a storm damages your property or injures your guests, your new vacation home will need financial protection. Insurance protects you, your guests, and your property – win, win, win. Let’s take a closer look at vacation rental insurance, including costs, types, and mistakes to avoid.

What does vacation rental insurance cover?

Vacation rental insurance is commercial real estate insurance specifically designed to cover vacation rental properties. A vacation rental property is a second home that you own and rent out to others on a regular basis. Renting can be done through property management services or platforms such as Airbnb.

Think of vacation rental insurance coverage like homeowner’s insurance on steroids. Typical homeowners insurance does not provide the liability coverage you need for rental properties. Similarly, first-party coverage may be excluded if the insurance company learns that the property is regularly rented out.

A standard vacation rental policy covers two areas:

Initial Coverage: This insurance protects your physical property from certain specified losses, similar to standard homeowners insurance. These losses are typically weather-related (wind, lightning, hail), human-related (theft, vandalism), or a mixture of both (fire). Secondary coverage: protects you from legal liability. A liability loss can be as simple as someone tripping and falling on the sidewalk while walking in front of your home and getting injured, or a guest slips and falls down the stairs and ends up in the hospital with a broken coccyx. . The liability portion of your insurance can help you with your claim while protecting you from any type of legal action.

You may also find that vacancies are important to insurance companies. If your home is vacant for an extended period of time and you file a claim, your insurance company may argue that there is no insurable interest on an unmonitored vacant property and may not pay your claim. If your home is vacant for half of the year, you may want to consider a vacation rental policy that has a vacancy rider or allows you to switch between a vacation rental policy and a vacancy policy.

Vacation rental insurance costs

The average cost of vacation rental insurance is about 20% more than standard homeowners insurance insurance. The national average cost of homeowners insurance in 2022 was $1,775. Therefore, the average cost of vacation rental insurance is $2,130. Of course, prices can vary somewhat. When determining insurance premiums, insurance companies consider standard data such as:

![]()

![]()

![]()

![]()

![]()

Age of house:

The age of the house is important. This is because the wiring may be old and prone to fires, or may be constructed using materials that are difficult to obtain, resulting in high repair costs.

![]()

![]()

![]()

![]()

![]()

House size:

Typically, the larger the square footage, the higher the premium.

![]()

![]()

![]()

![]()

![]()

Home location:

Location is important, especially when it comes to potential natural disasters. For example, Florida has the highest homeowner’s insurance premiums, averaging more than $2,400, according to the Insurance Information Institute. Hurricanes are also more likely to hit Florida than they are in Connecticut, where the average homeowner’s insurance premium is $1,600.

![]()

![]()

![]()

![]()

![]()

Fee:

For insurance companies, the past is the best indicator of future performance. If you have made a claim within the past three to five years, you can expect your premiums to increase.

Going forward, providers will factor additional considerations into vacation rental policy premiums.

How often do you rent out your property? Do you rent year-round, only during the summer, or only six months? Do you use some kind of background service to authenticate guests? Are there amenities like a pool, trampoline, boat launch, etc.? If so, the price will reflect the increased risk.

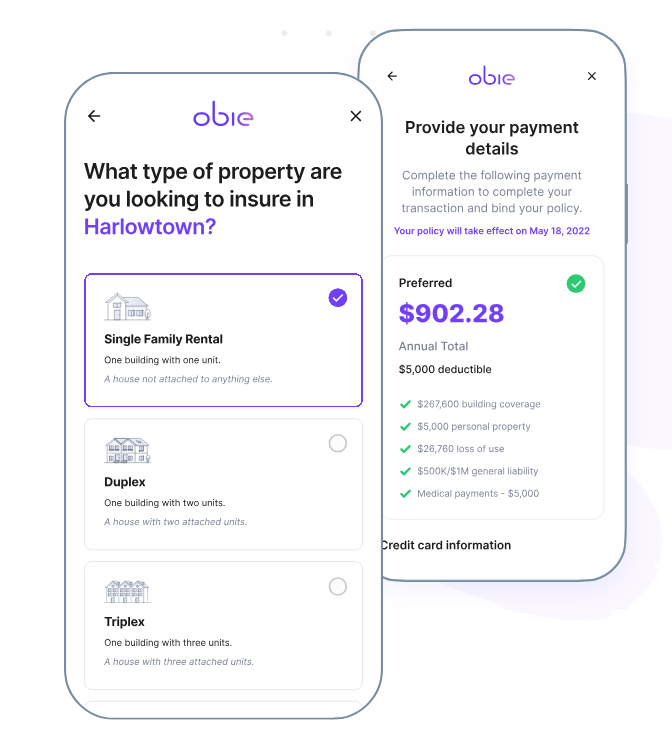

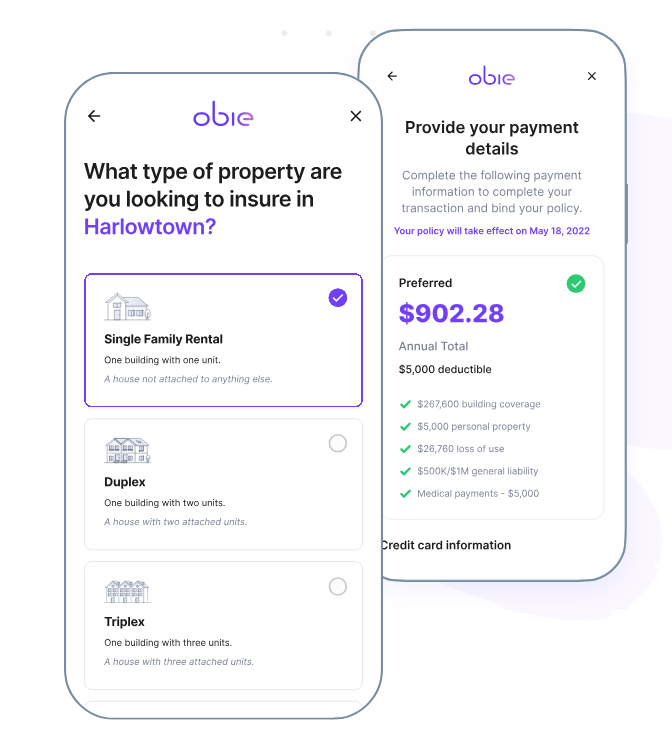

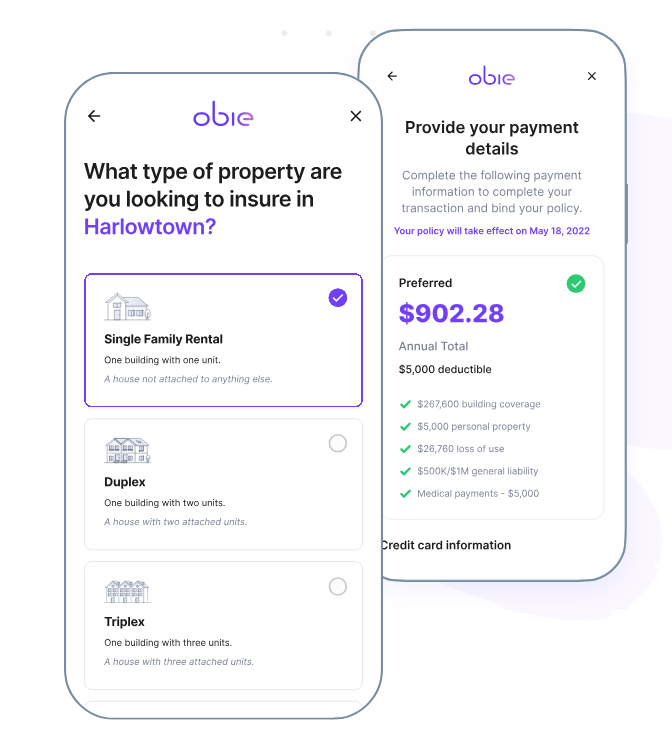

Obie is a digital broker specializing in homeowners and vacation rental insurance. Its comprehensive policy includes an inflation guard to ensure your property doesn’t go uninsured. Get a quote online from Obie in minutes and start purchasing vacation rental insurance.

Do you want to know which states are best to invest in? We worked hard for you and compiled a list of the top 10 best states for real estate investing. Check it out!

Various types of vacation rental insurance

It may be easier to understand if you think of private lodging insurance as a type of insurance. The specific type of insurance you purchase will ultimately depend on how you plan to use your property.

homeowner policy

If this is your second home and you rent it out only occasionally, homeowner’s insurance may be sufficient. Importantly, you should check with your provider to find out if you can rent it and whether you will be covered when you rent it. Some carriers allow you to add an endorsement (also known as short-term rental insurance) to your homeowner’s insurance for a limited rental period. If this is enough coverage and you’re happy with it, this is probably the easiest and cheapest option.

landlord policy

If your vacation rental is rented out year-round, or rented out so often that homeowner’s insurance isn’t enough, check your landlord’s policy. Landlord policies include additional liability coverage for rentals of real estate. The properties part can cover the content. If the house is unfurnished, you can also limit it to just the building.

There are several important considerations when determining whether a landlord’s policy is appropriate for your vacation rental.

Business Interruption Insurance: Most landlord policies do not include business interruption insurance. If something happens and you are no longer able to rent the property, you may not be able to receive financial assistance. Premises Liability: Landlord liability is usually only premises liability. This means you won’t be compensated if something happens to your guests off-premises. For example, if your rental property has bicycles or kayaks available for guests to use, and you are injured while using them off-premises, your landlord’s insurance will not cover your injuries.

To complicate matters further, some insurance companies offer business owners insurance on vacation rental properties, but call it landlord insurance. The key is to discuss your property, business, and needs with your carrier to determine which insurance is right for you.

Business owner policy

Business Owners Insurance (BOP) combines multiple types of coverage, all bundled into one policy. These insurances are commercial property insurance, general liability insurance, and business interruption insurance. There are three scenarios in which this would be the best policy for your vacation rental, or a must.

First, if your insurance company determines that your property is primarily a business, you can expect to need this insurance. Second, if you rent out year-round and want higher liability limits and business interruption insurance, BOP is the best option for you. Third, if you want more than prerequisite liability, you will need a BOP.

If you’re considering getting into rental property and becoming a landlord, check out the latest market updates in your state. For example, did you know that some states are better for landlords than others? Check out our guide to learn more.

Benefits of insurance for investors

Claims come in many forms. Some are mundane, like a storm damaging the roof of a new property or causing a tragedy. For example, there was this unfortunate accident.

Case Study: The Insurance Journal reports on a tragic incident in the summer of 2024 in which a couple was electrocuted in a hot tub with faulty wiring. The husband died and the wife was seriously injured. They filed a lawsuit against the property owner, alleging there was no signage warning of the dangers of the hot tub and that staff did not respond quickly enough when the incident occurred.

Although this example is from a resort, it highlights many of the risks you may face if you own vacation rental properties. If your property isn’t properly insured, something as seemingly harmless as a hot tub can turn deadly and lead to significant losses.

Purchasing vacation rental insurance has other benefits for investors. In advertising, it helps to let clients know that they have the proper insurance. When using platforms like VRBO or property management systems, many require proof of insurance.

If you are looking for a loan, even if you need cash, it will be easier to obtain a loan if you can prove that the property is insured. In fact, most banks require that your property be insured when you take out a loan.

Tips on choosing vacation rental insurance

Choosing insurance can seem difficult. Here are some tips to simplify the process and stay focused on your needs.

Make sure your policy has no exclusions for your business. For example, homeowners insurance includes liability coverage, but typically has very low limits and excludes business use. Renting your property is considered business use. Please inquire about the coverage offered. Specifically, find out what type of coverage is offered, its limits, and whether there are any exclusions for vacant properties. Consider the costs of investigation, defense, litigation costs, settlement fees if negligence is found, and payment costs. Some policies have a liability limit of $50,000 or even $300,000. A liability limit of $1 million is not much more expensive than $500,000, but it provides much better protection. Find out how the company handles property loss claims and response times. For example, when I started in the insurance industry, I worked second shift on weekends reporting commercial claims. We didn’t get many calls, but when a business owner suffered a major loss due to a fire or other incident at 11pm on a Friday, it was a huge relief for them to have someone they could talk to who could start the process right away.

Stay informed during the quoting process to ensure the insurance you purchase is compatible with how your property will be used.

FAQ

Does renters insurance apply to vacation rentals?

no. Renters insurance covers renters and their contents in their place of residence. It does not include renting a property for a vacation.

What is the difference between Airbnb and vacation rentals?

Airbnb is a platform that facilitates connections between travelers and people looking to rent a temporary home. It’s part of the home-sharing economy, and renting out your home on Airbnb is a short-term rental. Vacation rentals typically rent out accommodations separate from a primary residence to travelers.

How is vacation rental insurance different from vacation insurance?

Vacation insurance is another name for travel insurance. I buy it when I go on a trip and want to avoid losing the time and money I spent traveling due to canceled flights or illness while abroad. Vacation rental insurance is purchased to cover your property and protect yourself and your business from liability claims.

bring everything together

Don’t forget about insurance when developing your investment strategy. This is one of the safest and smartest methods. Vacation rental insurance makes a lot of sense. This will help if your vacation home is damaged or if a guest gets injured while using your property. Why do “what ifs” and “worries” remain in your mind when you can sleep peacefully with insurance?