This story was originally published at BiggerPockets.com

If you’ve ever looked into how mortgage loan repayment works, you’ve likely heard the term “amortization.” Amortized loans are the most common types of real estate loans, offering a predictable monthly payment with decreasing interest payments instead of compounding interest over the loan term.

All investors should know how amortization in real estate works and how it can impact your monthly payment, so let’s dive in.

What Is Amortization?

Amortization is a gradual process, allowing a borrower to pay off the loan amount in equal payment installments while paying down the principal and interest balances in varying amounts over the loan term.

Real estate mortgages use amortization to ensure that borrowers have a set mortgage rate every month (assuming a fixed interest rate), though over time their principal payments become larger as the interest payments drop. If you make extra payments, you can decrease the principal amount, which in turn decreases the total amount of interest owed and the lifespan of the loan.

On the first day the loan is funded, the entire balance is outstanding.

There are a few different types of amortization to consider when choosing a mortgage loan. They include the following:

Positive amortization

In positive amortization loans, lenders require the borrower to pay part of the principal with each loan payment. This reduces their repayment risk. The loan balance, therefore, will decrease with each monthly payment.

In other words, you’ll likely start the loan with a higher percentage of your payment going to interest instead of the principal, but every month the loan balance ratio shifts until eventually each principal payment is more than the interest payment.

When fully amortized loans use positive amortization, the entire loan balance will be paid off by the completion of the loan.

Negative amortization

With negative amortization, borrowers make the required monthly payments on a loan, but it isn’t balanced like in positive amortization. As a result, the amount they owe continues to rise, making it harder to afford the loan, because the minimum payment doesn’t cover the cost of the interest itself.

When this happens, the unpaid interest is added to the total loan balance. You can easily end up owing more than the mortgage is worth, so it’s best to avoid negative amortization loans in most cases.

How Does Amortization in Real Estate Work?

Amortization in real estate works differently depending on the specific type of amortizing loan you choose, because the structure of the loan—and what your payments go toward—vary significantly. Let’s look at how real estate loan types impact amortization.

Fixed-rate mortgages

Fixed-rate mortgages provide predictable monthly payments and a great deal of security for borrowers. You know exactly what rate you’re getting, and it will stay the same for the duration of the loan, unless you choose to refinance. Fixed monthly interest rates offer stability, which can be a huge asset when it comes to financial planning.

While your monthly payment may fluctuate based on property tax or insurance rates, your monthly payment covering the principal balance and interest will be the same even as the home loan matures. With these mortgages, a higher percentage of your payment is applied to the interest, but that shifts over time.

Adjustable-rate mortgages (ARMs)

Adjustable-rate mortgages (ARMs) often offer a lower initial interest rate than fixed-rate mortgages, though they can increase over time.

Your interest rate will be fixed for an introductory period—which can last between five and 10 years, depending on the loan. After that period, your rate can fluctuate based on market interest rates and a predetermined index. This could work in your favor; if market rates decrease, your loan could too, but it can also result in increasing interest rates.

ARMs have caps on both the highest and lowest interest rate that your loan can incur, which can be used to help you determine if it’s a fit for you. Make sure that you can afford the highest potential interest rate on the loan before signing, because there’s no guarantee that rates will be low to refinance in the future.

Interest-only mortgage

An interest-only mortgage allows the buyer to only pay on the interest during the introductory period of the loan. For a 30-year interest-only loan, the introductory period is 10 years. After that, the entire principal balance and interest payments must be paid down during the remaining 20 years.

This can be appealing for those who want to keep their initial payments low; some real estate investors may take this approach while they make initial renovations and earn their first few years of profit before higher payments kick in, though you don’t gain any equity from payments made during the introductory period.

Balloon mortgages

Balloon loans are a less-conventional real estate loan option that could be a great fit for specific investors. It’s a type of mortgage financing that allows for interest-only payments during an introductory period. After that introductory period, however, a lump sum payment will be due at the end of the loan.

Many can’t afford to pay down a substantial part of the principal payment in one lump sum, so this can be risky and may cause people to need to refinance or sell the property down the line.

How to Calculate Amortization in Real Estate

Calculating amortization in real estate can feel overwhelming, but the good news is that most mortgage lenders provide an amortization schedule before closing. Your amortization schedule needs to be customized to your loan (factoring in your balance and interest rate), so you want to have a schedule created for your specific loan.

An amortization schedule will show your year-to-year breakdown of how much principal and interest you can expect to pay; it may also show you how your first total monthly payment is broken up into interest payments and principal payments.

Let’s walk through a quick example of how an amortization table looks and what it tells us about the nature of drawing down a loan over time:

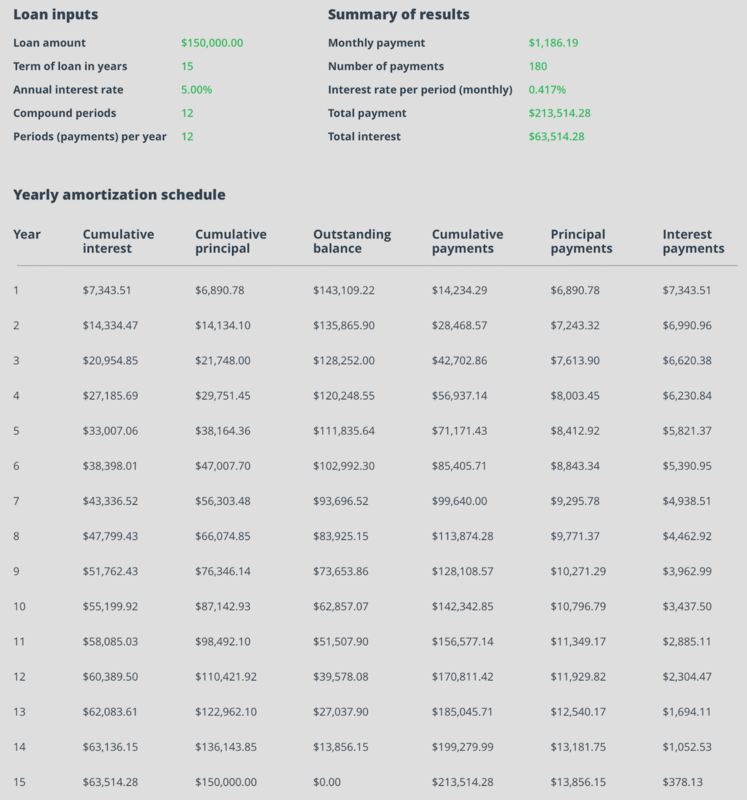

This is an amortization table for a $150,000 15-year fixed-rate mortgage. The interest rate on the mortgage is 5% annually, or 0.417% per month. Monthly payments of an equal amount are made by the mortgage holder of $1,186.19 per month. Over 15 years, the borrower will make 180 total payments, the last of which will reduce the principal owed to zero and close out the loan.

Draw your attention to the last two columns, for “Principal payments” and “Interest payments.” As you can see, each year more money is going toward drawing down the principal owed, and each year, more amortization occurs on the mortgage.

In year 1 of the mortgage, $6,890.78 is being amortized on the loan. In year 2, more is amortized ($7,243.32), and so on through the life of the mortgage.

If your mortgage lender doesn’t provide a loan amortization schedule, you can use a free amortization calculator online to better understand how your total monthly payment will pay off the outstanding principal balance and interest paid over the life of the loan. An amortization calculator can be an important tool in this process to calculate loan amortization.

Related: How to Make an Amortization Schedule

What’s the Difference Between Amortization and Depreciation?

Amortization and depreciation are two very different concepts related to financial assets, including a real estate property.

When it comes to real estate properties, the Internal Revenue Service (IRS) allows you to account for rental property decreased values over time due to assumed wear and tear of the asset over time. The assumption, of course, is that no home (or other tangible assets) will remain in ideal condition.

You can claim the depreciation of a residential rental property every year over a 27.5-year period. This allows you to deduct the depreciation on your tax return, potentially reducing the amount you owe. A certified public accountant (CPA) can help you determine how to calculate depreciation, along with any other business costs that can help you save come tax season.

Amortization, on the other hand, is the breakdown of how much you’re paying in interest vs. principal every month over the life of the loan.

Loan Amortization for Real Estate Investors

If you’re researching funding for a real estate property, an amortized loan will likely be your best bet, since most home loans (and personal loans) use an amortization schedule. Look for a positive amortization loan that allows you to pay down the principal loan amount in addition to interest payments, allowing you to gain equity while ensuring the outstanding loan balance is paid down over time.

Get the Best Funding

Quickly find and compare investor-friendly lenders who specialize in your unique investing strategy. It’s fast, free, and easier than ever!

Join the community

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.